Bitcoin Mining – Buy Low Mine High

Bitcoin mining is the backbone of the network where machines solve complex calculations. Mining is the process of finding new Bitcoin and verifying transactions on the network.

Compare it with mining for gold. At the bottom of the article you will find a technical explanation about the principles of mining and proof of work, but I don't want to bore everyone with this technical story.

How my journey started

During my crypto years, mining has come my way several times as an investment option. However, this never became concrete due to significant disadvantages such as:

Expensive electricity (10 times to high).

A lot of noise in you house or office.

Bizarre heat from the machines.

High investment and costs such as transport.

Monitoring maintenance and equipment.

Technical background required.

Bitcoin mining is the most lucrative industry

Bitcoin Mining is the most lucrative industry that world largest asset manager and investment fund BlackRock is betting big on. BlackRock recently became majority shareholder (over 51% assets) in of four of the five largest Bitcoin mining companies. This is not included in the almost 200.000 Bitcoin they bought for their spot ETF.

Then Bitcoin mining becomes exponentially more interesting than Bitcoin buying. With a power rate of 5.2 cents per kWh including hosting, security and maintenance. What does a Bitcoin miner cost? How can power rates be so low? Watch the interview or read the article and get all the answers!

Bitcoin Mining documentary

Benefits of mining through Epic Mining

Everything is arranged for you. All you have to do is watch how your capital increases and pay the electricity bill every month.

No noise or heat.

Cheap energy rates.

Only buy Bitcoin miners.

No maintenance.

No headache.

Blackrock and Bitcoin Mining: a sustainable combination?

Blackrock, the largest asset manager in the world, recently announced that it will add Bitcoin mining to its portfolio. Why did Blackrock make this decision and what are the benefits of this strategy? Blackrock sees bitcoin mining as a good investment for several reasons. First, Blackrock believes in the future of bitcoin as an alternative to traditional currencies and as a hedge against inflation. By investing in bitcoin mining, Blackrock can increase its exposure to the crypto market and benefit from the rising demand for bitcoin. They have now also received spot ETF approval for Bitcoin, which only makes things more bullish.

Secondly, Blackrock sees bitcoin mining as an opportunity to become more sustainable. Blackrock has committed to reducing its carbon footprint and supporting the transition to a low-carbon economy. Bitcoin mining can contribute to this by using renewable energy sources, such as solar energy, wind energy or hydropower. Blackrock can thus reduce its electricity costs and at the same time contribute to the reduction of CO2 emissions.

Blackrock has therefore discovered that bitcoin mining is a good investment, both financially and environmentally. Bitcoin mining allows Blackrock to capitalize on the growing crypto market and achieve its sustainability goals. If the largest institutional party in the world becomes the largest shareholder in 4 of the 5 largest mining companies, it seems to be a very good investment at the moment.

How are such 'low' electricity rates possible?

By mining Bitcoin in favorable areas in countries such as Siberia and Ethiopia at various Hydro Dams for cheap and green energy and they are also located in a mining facility with more than 80,000 devices or 5% of the total global mining. This ensures extremely low and competitive electricity rates through the joint purchasing of all facilities with all miners together.

Would you like to know whether mining could be intere3sting for you? Want to know more about the price of a miner? Questions about the mining farm? The technical side?

Mine Bitcoin instead of buying?

With Bitcoin mining you create Bitcoin below the production value. The higher the price of Bitcoin becomes, the more profit you can realize, because your production costs are below market value. If you believe that Bitcoin can shoot to 75.000, 100.000, 150.000 or even 200.000 in the next bull market or a cycle after that. Then mining Bitcoin becomes exponentially more interesting than buying Bitcoin. If the price of Bitcoin goes up, the costs to buy it become higher and higher. With mining you can continue to produce them below the market price. That is the revenue model used with mining. Then you don't even take into account the increase in the value of your machines if the price goes up. You can flip it for double if demand really gets high again.

What determines BTC price?

Factors increasing demand for Bitcoin:

Failure of the traditional financial system.

More and better education available.

Network effects.

BTC is the best asset ever in ROI.

Countries are buying Bitcoin.

Companies add Bitcoin on their balance.

Investment funds buy BTC like BlackRock.

Factors that make Bitcoin scarcer:

Bitcoin is halved every four years.

Holders do not sell, but buy from (hodlers).

Large mining companies have better access to financing and therefore they no longer sell BTC to finance their activities.

As demand increases and supply becomes scarcer, this can only mean one thing. The price is going to rise!

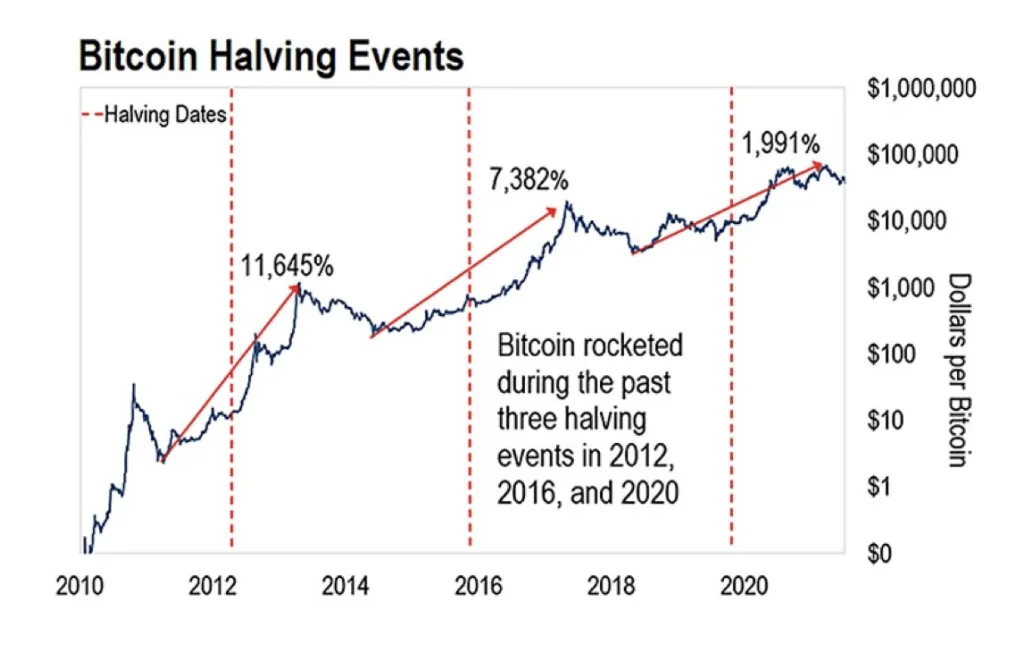

What traditionally happens after a Bitcoin halving?

After the market crashed in 2010, Bitcoin's price skyrocketed by 11,645%.

After the market crashed in 2014, the price of Bitcoin rose by 7,382%.

After the market crashed in 2017, the price of Bitcoin rose by 1,991%.

Bitcoin Mining profits

Obviously we all want to know what it can ultimately yield. This can easily amount from 10.000 to 25.000 Euro per machine over time. Book a free consultation and find out in a short conversation what exactly it is like!

Buy used Bitcoin machines

With each Bitcoin miner the owner receives a unique certificate that he can sell to someone else. That person then becomes the owner of the machine and must identify themselves to Epic Mining to change the address of the wallet being mined to and the natural person to whom the electricity bill is sent. This is different from ordering new miners, as these are new machines shipped from the factory to Ethiopia.

When you order a new Bitcoin miner, the purchasing and shipping process can take approximately 8 wee

\ks up to 90 days. Some people just want to start mining the next day and then second-hand machines are a good choice. For example, the machine in our webshop has only been in use since November 13. The new price of Bitcoin miners is quickly skyrocketing. So a second-hand machine with a lifespan of 4-5 years is a very interesting deal! Especially because you transfer the contracts within 24 hours and the machine will earn Bitcoin for you tomorrow!

The technical side of Bitcoin mining

Bitcoin mining is the process of creating new bitcoins and verifying transactions on the Bitcoin network. It is a crucial part of the cryptocurrency infrastructure.

Bitcoin operates on a decentralized network, meaning there is no central authority that controls the currency. Instead, transactions are verified by a network of computers (nodes) spread around the world. Miners are participants in this network who use specialized hardware and software to solve complex mathematical problems and validate transactions.

The mining process

Transaction Verification: When someone initiates a Bitcoin transaction, it is broadcast to the network. Miners collect these transactions into blocks.

Hashing : Miners compete to solve a mathematical puzzle, known as a cryptographic hashing function, by repeatedly guessing a specific value (nonce) until the desired outcome is obtained. The hashing process converts the block of transactions into a unique string of characters called a hash. Miners' computing power plays a role in increasing their chances of finding the right nonce and solving the puzzle.

Proof of work : The successful miner who solves the puzzle first broadcasts the newly mined block to the network. Other miners then verify the validity of the block and the transactions.

Block Addition : Once the block is verified, it is added to the existing blockchain, creating a permanent and immutable record of transactions. Miners receive a reward for their work in the form of newly minted bitcoins and transaction fees for the transactions in the block.

It is good to know that the mining process becomes more and more challenging over time. This is due to the design of the Bitcoin network, which adjusts the difficulty of the mathematical puzzle to ensure that new blocks are added approximately every 10 minutes, regardless of the total computing power of the network.

Bitcoin mining requires significant computing power and electricity. Therefore, specialized hardware called ASICs (Application-Specific Integrated Circuits) are often used to efficiently mine bitcoins. In addition, mining farms with numerous ASICs are often set up in locations with cheap electricity to maximize profitability.

Overall, bitcoin mining plays a vital role in securing the Bitcoin network, verifying transactions, and putting new bitcoins into circulation.

Bitcoin mining is divided among several companies that manage mining pools, which are groups of miners who share their computing power and distribute the rewards.

Foundry USA: based in America, with 30% of the network's hash rate. Foundry USA is a subsidiary of Foundry Digital, a company that provides mining equipment financing and advisory services to institutional investors and corporations.

Antpool: Based in China, with 23% of the network hash rate. Antpool is owned by Bitmain, one of the largest manufacturers of Bitcoin mining hardware and chips.

F2Pool: Based in China, with 18% of the network's hash rate. F2Pool is one of the oldest Bitcoin mining pools, founded in 2013.

Poolin: Another Chinese pool, with 12% of the network's hash rate. Poolin was founded in 2017 by former Bitmain employees.

Slush Pool: Based in the Czech Republic, with 7% of the network's hash rate. Slush Pool is the first Bitcoin mining pool, launched in 2010.

These five pools account for approximately 90% of the total Bitcoin mining power, meaning they have a significant impact on the security and decentralization of the network.

Cloud mining

Cloud mining is a service where private individuals rent computing power from companies to mine cryptocurrencies on their behalf. They don't have to own or manage the hardware themselves. The cloud mining provider handles the mining operations and distributes the rewards among participants based on their rented computing power. It is a way for people to mine cryptocurrencies without needing expensive equipment or technical expertise.